Would you lend $100 to a friend in need? What about $1,000 to a sibling? When it comes to lending money, everyone has their limits — and those limits can vary greatly depending on where you live in the United States. Whether it’s a quick loan to a co-worker or a more substantial amount for a family member, the decision to lend money is often influenced by personal values, financial security, and trust.

To explore these nuances, we conducted a state-by-state survey to uncover how willing Americans are to lend money to different people in their lives — be it parents, partners, friends, siblings, or even colleagues. Read on to see where your state stands and how your own lending habits compare to the rest of the nation.

The Stingiest (& Most Generous) States

When it comes to lending money, some states are notably more cautious than others. The following states rank as the stingiest, meaning their residents are the most reluctant to lend money to others, even those close to them. On the other end of the spectrum, we also have the most generous states, where people are more willing to open their wallets for loved ones.

The Stingiest States

Iowa tops the list as the stingiest state when it comes to lending money. A significant 44% of Iowans would never consider lending $1,000, and nearly a third (31%) would not even lend $500. Even for smaller amounts, like $100, over 22% of residents wouldn’t budge. The average amount at which an Iowan would get angry if a loved one didn’t repay is around $384, indicating a strong sense of financial caution and perhaps a lower threshold for trust when it comes to loans.

In Oklahoma, the reluctance to lend money is also high. With 41% of residents unwilling to lend $1,000 and 35% unwilling to lend $500, Oklahomans are second only to Iowans in their financial conservatism. Interestingly, only 7% would never consider lending $100, suggesting that small loans are more acceptable, but as the amount increases, so does the hesitation.

Mississippi ranks third on the list of stingiest states. Almost half of residents would not lend $1,000, making them the most cautious in the country when it comes to larger sums. The average amount that would lead to anger if not repaid is $593, higher than the above states, but still well below the national average of $905.

The Most Generous States

While some states hold tight to their wallets, others are much more willing to lend money to those they care about. The following states rank as the most generous, with residents showing a greater willingness to offer financial support, even at the risk of not being repaid.

Alabama is the most generous state when it comes to lending money. Only 24% of residents would refuse to lend $1,000, and just 10% would hesitate to lend $500. Even smaller loans are rarely refused, with only 6% of Alabamians unwilling to lend $100. This generosity is further highlighted by the fact that the average amount they would be upset about if not repaid is $1,425 — more than triple the threshold for Iowans.

New Jersey ranks second in generosity, with only 23% of residents unwilling to lend $1,000. This state also sees a low refusal rate for smaller amounts — 13% for $500 and just 4% for $100. Similarly to Alabamans, residents in New Jersey wouldn’t be upset at a loved one for not repaying the loan until it surpassed $1,190.

Utah takes third place among the most generous states, with 2 in 3 residents willing to lend $1,000 under certain circumstances. For smaller sums, the hesitation is minimal — 12% would not lend $500, and 6% would refuse to lend $100. The average anger threshold if a loan isn’t repaid is $961, suggesting that while Utahns are generous, they still have an expectation of repayment, especially for larger amounts.

A National Look at Lending Money

When it comes to lending money, the dynamics of who, how much, and under what conditions vary significantly across different relationships.

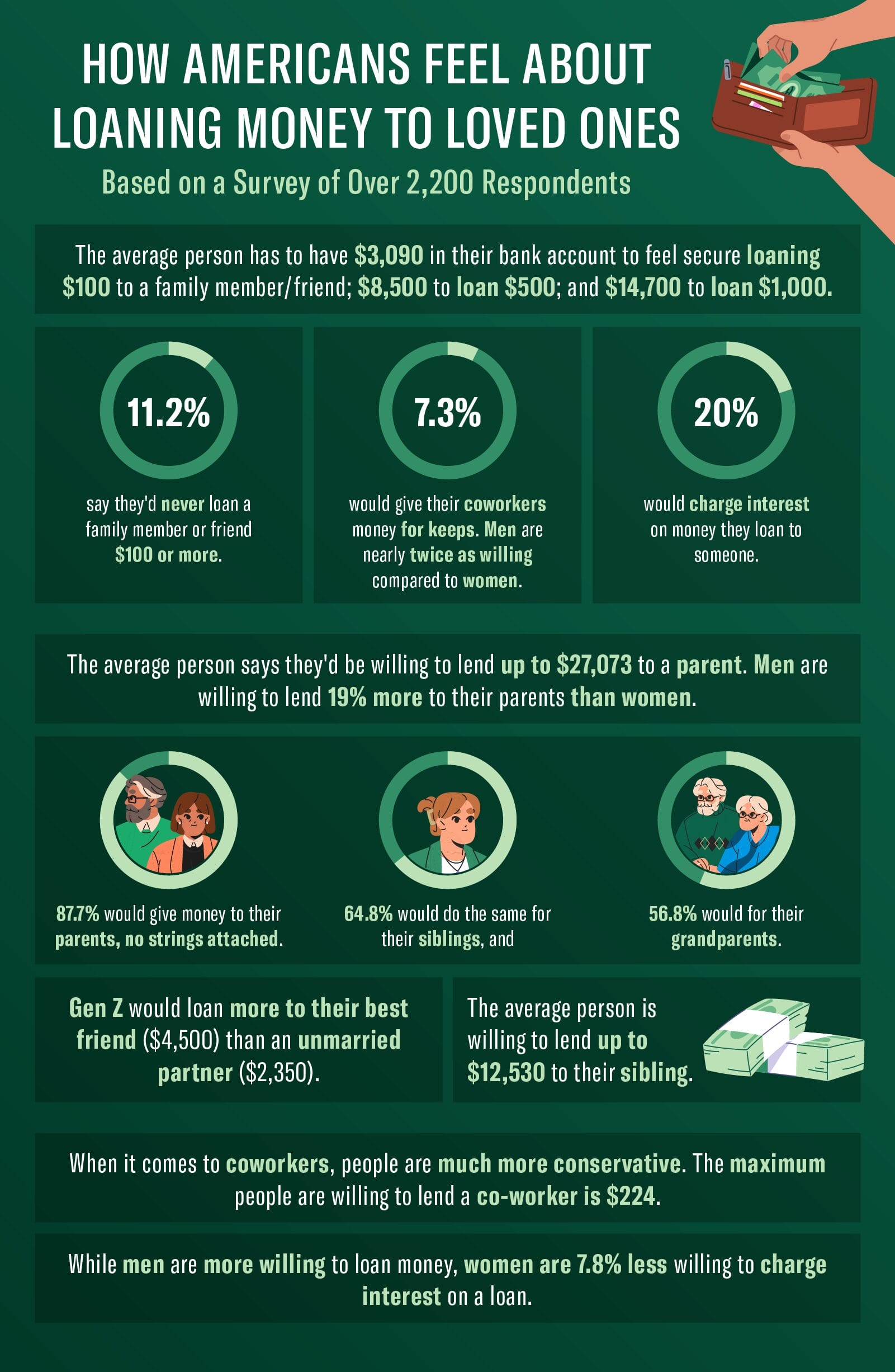

Many people need to feel financially secure before lending money. On average, Americans need to have at least $3,090 in their bank account before feeling comfortable lending $100 to a family member or friend. This threshold rises to $8,500 for a $500 loan and jumps to $14,700 when the amount reaches $1,000.

That said, the willingness to lend money varies widely depending on the relationship. Parents are the most likely recipients of larger loans, with the average person willing to lend up to $27,073 to a parent. Interestingly, men are 19% more willing to lend to their parents than women. Siblings also rank high in lending priorities, with the average person willing to lend up to $12,530 to a sibling.

When it comes to unmarried partners, the willingness to lend drops to a maximum of $7,230. Age also plays a role here—Baby Boomers are far more generous, willing to lend up to $16,730, compared to Gen Z, who are willing to part with just $2,350. In fact, Gen Z would lend more to their best friends ($4,500) than to an unmarried partner, showcasing a shift in priorities among younger generations.

Unsurprisingly, co-workers fall at the bottom of the lending spectrum, with people much more conservative about lending money in a professional setting. The maximum amount people are willing to lend to a co-worker is just $224. Only 7% of people would give money to a co-worker without expecting repayment.

Speaking of no strings attached, 88% would give money to their parents without expecting anything in return. Siblings and grandparents also fare well, with 65% and 57% of respondents willing to give money to them, respectively.

The decision to charge interest on a personal loan is another area where opinions diverge. About 1 in 5 Americans would charge interest on a loan to someone they know. Interestingly, while men are generally more willing to lend money, they are also more inclined to charge interest compared to women, who are 7.8% less likely to do so. This suggests that while women may be more cautious in lending, they are also less likely to formalize the transaction with interest.

Closing Thoughts

As our survey reveals, lending money is a deeply personal decision shaped by various factors, including financial security, the relationship between the lender and borrower, and even regional differences across the United States. In the end, the decision to lend money often comes down to a delicate balance between the desire to help and the need to protect one’s financial stability.

At BetMGM, we understand the importance of minimizing risk — whether you’re spinning reels on a slot or considering a loan to a loved one. Just as with lending, playing online casino games is about knowing your limits, mitigating high-risk situations, and making choices that align with your values and financial goals. As you reflect on your own lending habits, remember to apply the same thoughtful consideration to your entertainment choices.

Methodology

This data is based on over 2,200 survey respondents, collected and analyzed in July of 2024. The following states were not included due to insufficient survey respondents: Alaska, Montana, North Dakota, South Dakota, Vermont, Washington, D.C., and Wyoming.

The “stingy” ranking indicates the states that are most and least willing to lend money to friends and family, with 1 indicating the state least willing to lend money. The ranking is based on respondents answers to a variety of questions, including how much they’d loan to various people, the percentage of people that would never loan various amounts, and what amount they’d get upset over.