Solid advice for any adult in the United States is to never mess with the IRS. The Internal Revenue Service in the US is responsible for assuring compliance with the nation’s tax laws, including personal income taxes.

Likewise, many jurisdictions within the US levy income taxes. This includes local and state governments. When it comes to gambling winnings, they treat them much the same as the IRS does.

As far as the IRS and these other agencies are concerned, any gambling winnings you receive are taxable income. If you fail to report and potentially pay tax owed upon them, you can face significant penalties.

Exactly what those penalties might be greatly varies depending on your situation. Suffice to say, none of them are pleasant.

How to Avoid Problems With Gambling Winnings and Taxes

The best thing you can do in any aspect related to income taxes is to keep detailed records. That applies to gambling winnings.

You should assume that all and any gambling winnings you receive throughout the year are taxable income. At a minimum, you will have to report them to the IRS and/or other relevant jurisdictions.

You may owe additional tax on those winnings, depending on your situation. Besides keeping detailed records, the next best thing you can do is to enlist the aid of an experienced, qualified tax professional.

Those professionals can help you ensure that you have correctly reported and adequately paid any tax you might owe on those winnings. The piece of mind alone is worth the expense.

Failing to report, underreporting, failure to pay, and underpayment can all cause significant issues in your personal and professional life. You’ll save money by doing everything right the first time.

What Can Happen if You Don’t Report Gambling Winnings Correctly

Even the absolute best-case scenario in this situation can be costly. At the very least, you will face penalties for failing to report and perhaps pay tax owed on your gambling winnings.

Additionally, the IRS and respective governments will probably charge interest on any underpayment outstanding against you. That interest will continue to accrue until you settle the outstanding balance.

If your balance remains unpaid for a long enough amount of time and/or is large enough, the IRS and/or other governments can secure a judgment against you that will allow more aggressive enforcement actions. That can include seizing assets like your home, savings, and vehicles against your balance.

If you find yourself facing such circumstances, the best thing to do is retain legal counsel who has experience in litigating tax issues. They may be able to secure a reduced settlement or other more favorable terms.

The income tax issue is one reason why playing online casino games with BetMGM is a good decision. BetMGM wants to make sure you can enjoy your play without worrying about tax compliance.

How BetMGM Helps You Ensure Compliance With Tax Laws

Because BetMGM is a licensed and regulated online casino operator in four US states, it strives to comply with all applicable standards. That includes correctly maintaining player records and withholding requirements.

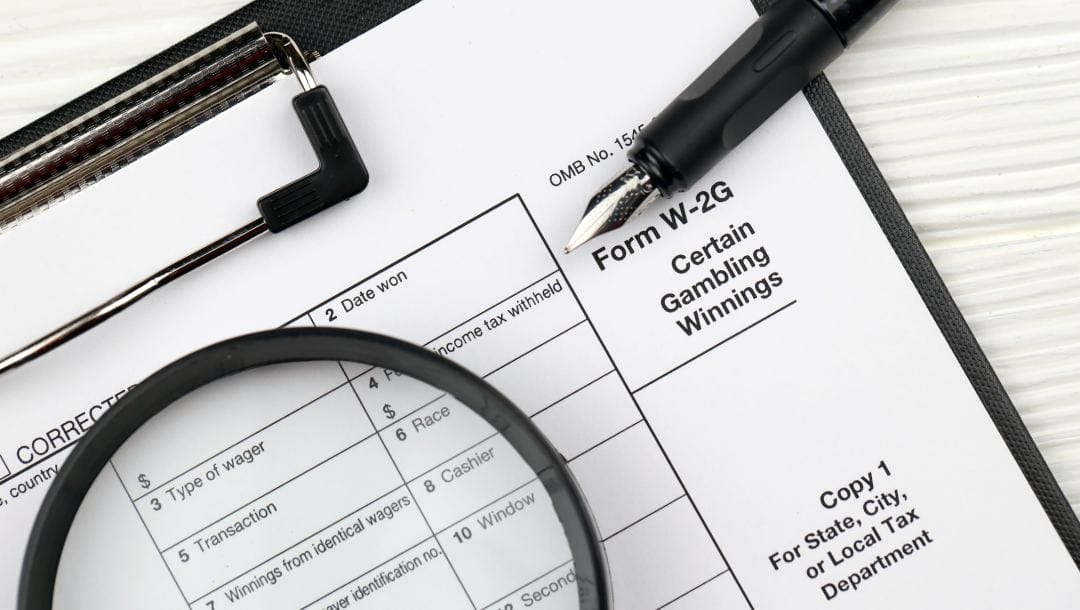

If you have sufficient qualifying gambling winnings in a particular tax year, you can expect to receive a Form W2-G from BetMGM. This form makes it easy for you or the tax professional you hire to report your gaming winnings.

Essentially, BetMGM’s platform takes care of the record-keeping for you, making a line-item history of your gambling activity easy to access at any time. Furthermore, BetMGM may take care of the payment for you.

Should your winnings qualify, BetMGM will withhold the statutory amounts from your winnings. That might take care of the tax you owe, but you should never assume that is the case. You will still need to report your winnings and consult with a tax professional to ensure that you do not owe any additional tax on your winnings.

When you play with BetMGM, you can rest easy that your gaming complies with the law. When it comes to taxes, that’s the best place to be.

To play legal online games, register at BetMGM Casino.